Alex Bramwell

The Reforestation Of Gran Canaria: Righting A Historical Wrong

Gran Canaria's recent wildfires have highlighted the importance of the island's forests. Here's why they are so important and what is being done to replant and maintain them.

Gran Canaria Fire Spreading: Glimmers Of Hope Emerging

The Gran Canaria fires has burned through the night and is expected to continue to spread today due to high temperatures and winds. The Tamadaba forest in the west is ablaze and possibly unsaveable.

Uncontrollable Gran Canaria Fire Reaches Tamadaba Forest

The Gran Canaria fire has burned out of control across the highlands all day and has now made its way into the vast and pristine Tamadaba pine forests of north west Gran Canaria.

New Gran Canaria Fire Out Of Control Amid New Evacuations

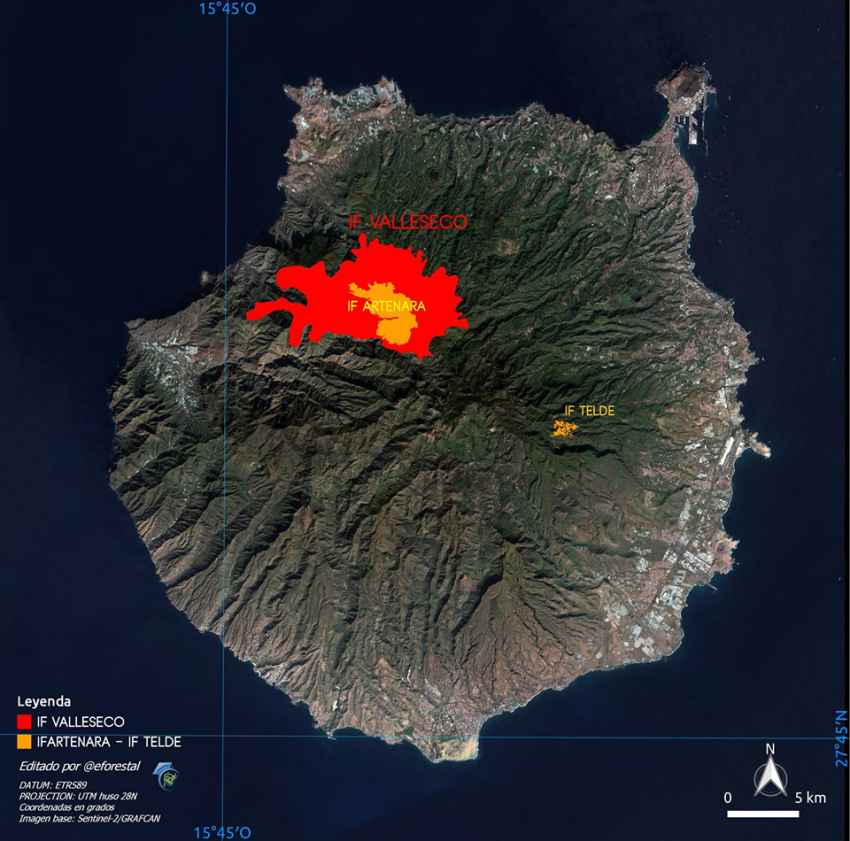

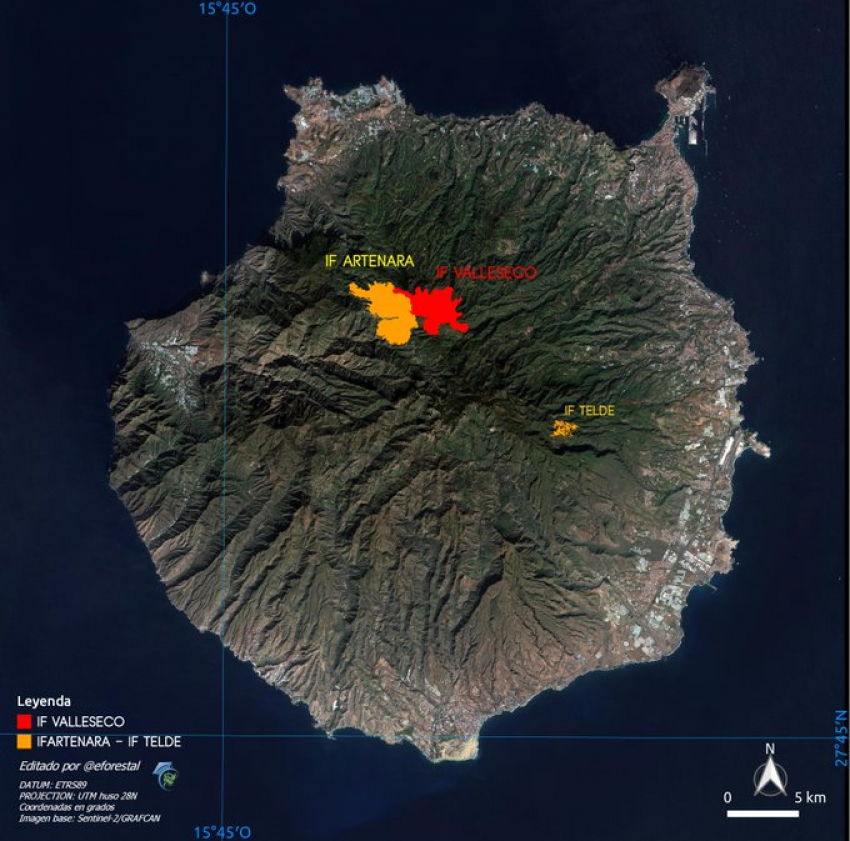

A new fire that started in the forest just above Valleseco in the northern Gran Canaria highlands has now burned over 1000 hectares of forest and countryside and is spreading.

Making Sense Of Gran Canaria Forest Fires

Gran Canaria forest fires are spectacular events but the island is well-prepared to deal with them and most are extinguished before they get out of control. Tourists and visitors are not at risk as Gran Canaria wildfires happen up in the mountains a long way from the resorts and the airport.

Living In Gran Canaria: Resident Discounts & Perks

There are lots of perks to living in Gran Canaria, including the weather, the cheap petrol and wine, and the general smugness that it gives you. Then there are the Gran Canaria resident discounts …

Here’s our guide to the top discounts that Gran Canaria residents are entitled to.

Gran Canaria resident discounts on inter-island transport

Once you get your Gran Canaria residencia, make sure you register for the 50% discount on travel between the Canary Islands. Most municipios allow you to do it online, but the system isn’t perfect so it may not recognise you straight away.

If you have a problem, just head to your ayuntamiento and ask for “el certificado de residencia para bonificación de viajes”. It costs a few euros and you need to show it to each transport company at least once to get into their system as a resident.

If you book resident fares without a certificate, the travel companies will ask you to pay up, or even refuse you passage.

Travel To Mainland Spain for Gran Canaria residents

Canary Islands residents get 50% of travel between the islands and mainland Spain. However, be careful when you book an indirect flight through a Spanish airport. Some airline websites apply the discount to the second leg, then get in a huff when you check in.

The discount is only valid between the Canaries and your first Spanish stop.

Taking a car from Gran Canaria to the Mainland? The 50% discount also applies to ferry travel.

Money off the Yellow Submarine and other tourist attractions

Most tourist attractions offer a resident discount. For example, if you book the Yellow Submarine as a resident you get a 20% discount. Add this to the 10% discount you get for booking online, and you’ve saved a good chunk of change.

Frequent use tickets for residents

Another offer to look out for is frequent user tickets from theme parks like Palmitos Park. You can often buy a ticket that gives you unlimited trips for the cost of two or three visits. Not much use if you’re a tourist, but pretty good value if you are resident. The Angry Birds Park in Puerto Rico does an annual use ticket that is great value if you live close by and can use it regularly.

Discount museum & gallery entry

Lots of Gran Canaria’s museums offer cut-price entrance to residents. All you need is your green NIE form or card.

Also, look out for free entry days at Gran Canaria museums. For example, many museums are free on the first Sunday of the month.

Living In Gran Canaria: Really Useful Websites

Here’s a list of useful websites about Gran Canaria that we use all the time.

Living In Gran Canaria: Opening A Bank Account

Getting a bank account in Gran Canaria is a doddle if you have an NIE or residencia. Just pick a bank and give them your NIE number, passport and a proof of address (utility bill, rent contract).

Then sign a lot of bits of paper and you have an account.

In theory, you can open a non-resident bank account with a passport. You may have to try several banks as some won’t do it without a NIE certificate. Commissions are high, so swap over to a resident’s account as soon as you can.

Which Gran Canaria bank to choose?

There isn’t much between them, but bear these factors in mind.

Smaller banks have few cashpoints and charges for withdrawing money can be eye-watering.

Some banks, such as Santander, don’t charge monthly commissions if you pay in your salary or pension.

Queues in bank branches get long, so pick a bank with a decent online banking system.

Here’s a selection of the main banks in Gran Canaria

La Caixa

La Caixa took over Bankia and now has more offices and cashpoints than any other Gran Canaria bank. Big branches have English-speaking staff and there is English speaking telephone support and English internet banking.

Santander Central Hispano

The same company as Santander in the UK, but you can’t transfer an account or anything convenient like that. Santander has plenty of Gran Canaria branches, a decent network of ATMs, and offers commission-free banking if you have a salary.

Santander has plenty of Gran Canaria branches, a decent network of ATMs, and offers commission-free banking if you have a salary. It even pays interest on your current account balance.

ING Direct

Dutch bank with a couple of Las Palmas branches. ING has an excellent online bank system and even decent queue management in its branches. A good mortgage option.

EVO Banco

A specialist online bank with a handy branch on Mesa y Lopez.

Bank Inter

A bank that does offer good mortgage terms to non-resident buyers

BBVA

Like Santander, but blue instead of red.

Barclays

The same company as Barclays in the UK, but you wouldn’t know it. If you have a UK Barclays account there is no advantage opening a Spanish Barclays account.

Share this:

Living In Gran Canaria: Setting Up A Tax Efficient Company (ZEC)

The Canary Islands offer the most generous tax regime in the whole of Europe for companies and entrepreneurs.

Gran Canaria is part of the ZEC, or Canary Islands Special Zone. What’s special about it?

Well, open a business in Gran Canaria and tick all the boxes, and you pay just 4% corporate income tax and gets a slew of other benefits.

What is the ZEC?

The ZEC is a low-taxation zone focused on the Canary Islands. Its main purpose is to encourage European businesses to move to the Canaries, or set up subsidiaries here, to provide jobs and experience to local people and boost the economy. In exchange, it offers businesses one of the lowest corporate tax regimes in Europe.

The ZEC has the full support of the EU, the Spanish tax authorities, and the Canarian Government. It stands out as one of the few legally sound low-taxation centres in Europe. If you are planning to set up a Gran Canaria business, you need to know about the ZEC.

It’s also well established with over 400 ZEC companies, including Rolls Royce, currently operating in the Canary Islands. ZEC entities employ over 4500 people on the islands.

The advantages of a ZEC business in Gran Canaria

ZEC companies pay Spanish Corporate Income Tax at 4% (the EU average is 23%).

ZEC companies can pay dividends to their EU subsidiaries of parent company without any withholding tax. This is thanks to the Parent-Subsidiary Directive of the European Union.

ZEC firms also benefit from the 85 double taxation treaties established between the EU and other countries.

A ZEC entity is also exempt from Property Transfer Tax and Stamp Duty (ITP-AJD).

Imports made by ZEC companies, and goods and services traded between them, are exempt from Canary Islands General Indirect Tax (IGIC). Canarian IGIC is the equivalent of VAT and is currently 7%.

Why set up a ZEC Gran Canaria business

Gran Canaria has the largest city in the Canary Islands in Las Palmas de Gran Canaria, and the largest port. It’s also well connected to the rest of Europe and to Africa by air, and has a large, and booming tourism industry and a growing oil-services sector.

It’s the logical choice of location to set up a ZEC business as it has the best infrastucture and support services in the Canary Islands (Tenerife may well disagree about this). Salaries are low by European standards, and there is a healthy pool of university-educated Canarians looking for work.

From a lifestyle point of view, Gran Canaria takes some beating. It has excellent weather, a huge range of quality restaurants and bars and all the services and security you’d expect from a European city. In short, an excellent place to live and work.

What are the requirements for setting up a ZEC business in Gran Canaria?

A ZEC company must be a new corporate entity based in the Canary Islands.

At least one of the administrators or legal representatives must reside in the Canary Islands.

A ZEC entity must make a minimum investment of 100,000 euros (in Gran Canaria and Tenerife) or 50,000 euros (in the other Islands) in fixed assets within the first two years. This investment can be in Gran Canaria property.

ZEC companies must create 5 jobs (in Gran Canaria and Tenerife) or 3 (in the other islands) during the first six months, and maintain this minimum number of employees on average.

ZEC entities must also be in one of these sectors or service industries.

NOTE: The list of approved sectors is long and most companies will be able to find a way to fit their activities into the ZEC rules. Service companies can set up anywhere in the Canary Islands.

How do I set up a ZEC company in Gran Canaria?

The first stage is to make contact with the ZEC organisation. They will provide all the information you need to get set up, a road map of procedures, and ongoing support.

There is a fair amount of paperwork associated with the process (you need to get your business activity approved, start a local company, register with tax authorities, etc) so it takes months rather than weeks. The best way to get this done effectively is to use a quality local business consultant, such as Montelongo Asesores, to get all the paperwork sorted.

We’d also advise you to network with people who have already established ZEC businesses on the island. They will give you invaluable advice about how to set up in Gran Canaria.

As for costs, it’s €850 to inscribe your company in the ZEC registry and between €1300 and €1500 per annum thereafter.

Living In Gran Canaria: Importing A Car

When you see the prices of second hand cars in Gran Canaria you will probably think about importing a much cheaper car from mainland Europe or the UK. Whilst overall it can be cheaper importing a car there are many costs involved in importing a car to the Canary Islands and you need to consider them carefully before bringing your car here.

The first thing you need to know is that when importing goods into the Canary Islands the Canary Islands are not considered part of Spain, therefore any advice taken from Spanish companies will not be applicable to Gran Canaria, this is particularly important for importation tax. In Spain for some goods you are not liable to pay import tax, for the Canary Islands you are.

Important points on importing cars to Gran Canaria from the EU

If you have owned the vehicle for less than six months you will be taxed heavily.

If you have had a Spanish ID number (NIE) for more than 6 months, again you are liable to be taxed the import duty. This is 9-13% of the value of the car in Spain.

However, if you have owned the car for some time and you are a new resident in the Canaries you are allowed a one-off importation of your goods and import tax is not payable. You will need to obtain a document from your local authority in your origin country before you leave to demonstrate that you have been living there. This, along with local documents will prove your exemption from import tax.

There are additional charges once you arrive, these include matriculation and putting the car through the ITV. These can be up to 200€.

If you are confused have a look at the Agencia Tributaria website for the latest information however this can be often be even more confusing so if in doubt get in contact with a shipping agent such as Migrate Global Canarias.

Once you bring a car to the Canary Islands you are allowed to drive it here for up to 6 months before putting it on Spanish plates, if you don’t re-register it here in the Canary Islands within 6 months you are liable to pay extra charges. However if you take it out within 6 months you don’t have to pay anything.

You may have noted that used cars in the Canaries are not always good value for money. However, you should bear the above points in mind when deciding whether to ship your vehicle to Gran Canaria.

Driving your car into Gran Canaria

One alternative is to pack up your car, drive down to Cadiz or Huelva and use the ferry service. This can be an economical way of shipping a car and all your belongings to Gran Canaria, although it is not without cost and the sailing is 24 hours so it's quite a journey. Many people enjoy the adventure though, and if you already have Canarian residency documents you are entitled to a 75% discount on the ferry cost.

Shipping your car to Gran Canaria

Shipping vehicles to Gran Canaria, without actually driving them, is also common practice. From some parts of Europe and mainland Spain there is a roll-on, roll-off service, whereby you put your vehicle on the ferry at one end and collect it at the other end. Currently the only option available directly from the UK or Ireland is containerized shipping, which can be costly, but which is very safe and also offers you the option of moving personal/ household goods in the same container. The usual procedure is for you to deliver the vehicle to a nominated warehouse near your UK or Ireland address, where it will be loaded on a container, secured for sea transit and shipped here for you. If you are combining this with a household removal, that side of it would be carried out as normal, with a packing service if necessary, a collection, followed by loading together with the car at the warehouse.

Customs Clearance

All unaccompanied goods travelling between the Canaries and the rest of the world, including Europe and mainland Spain, have to clear customs. This is usually a paper-based procedure, although some containers are opened and inspected, but the important thing to know from the outset is the documents you will be asked for, which are NIE and certificado de empadronamiento (see ‘Paperwork’). If you have used a door-to-door removals or transport service you will simply be required to provide these documents and customs clearance will be carried out on your behalf. Otherwise you will need to appoint a customs agent to represent you and you will have to sign some further documents and provide an inventory of contents.

Gran Canaria Info recommends:

- Default

- Title

- Date

- Random